About Us

Introduction

Our Background Story

At Wealth Concepts, we understand the importance of savings for future while making the most of the present. Building wealth depends on sound financial saving that involves 2 key steps: Saving and Investing smartly.

Making the change from Savings to Investing is critical to generating right returns. High inflation, fluctuating interest rate environment and volatile market conditions make it necessary to have an astute asset allocation, firm financial saving, along with steady oversight, at all times.

The keystone of our advisory is transparency. There is absolutely no conflict of interest when it comes to picking the right investment tools. We will direct you to the best and widest range of investments that fit our investment philosophy.

We believe

- A disciplined, well-defined process leads to favourable investment outcomes over time.

- In following the asset-allocation methodology at all times, taking a dispassionate view on the various investment tools and choosing only what fits best.

- Maintaining a firm vigil on the progress of your investment portfolio.

- A down-to-earth communication style that does not bask in sophisticated jargons to validate our importance.

- Investor behaviour plays a critical role in determining long-term investment outcomes.

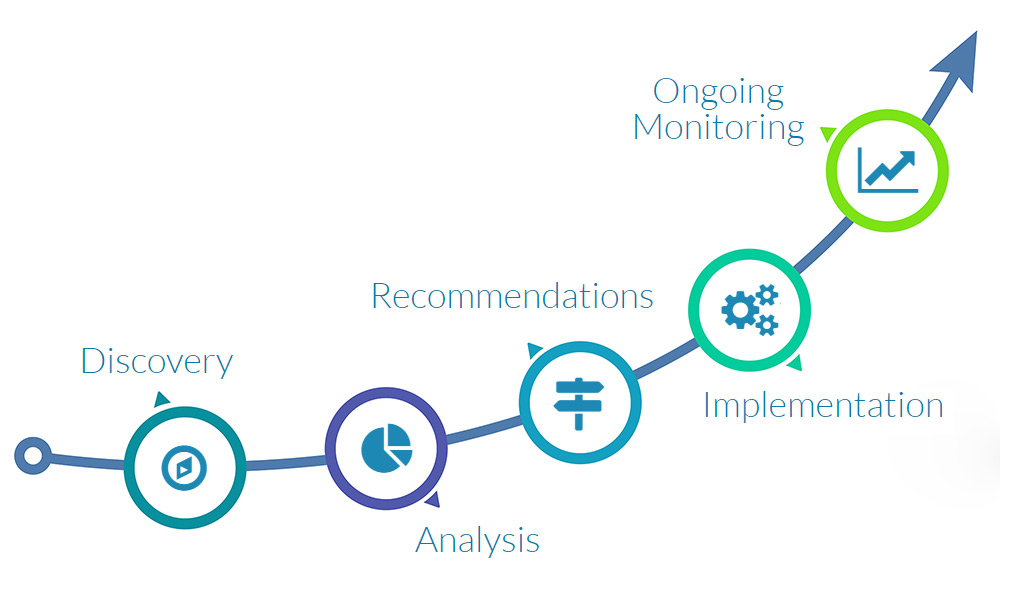

Steps to Solutioning: Discovery, Structuring, Execution and Monitoring

- In the Discovery phase, we help you identify your investment objectives, liquidity requirements, fund availability and risk tolerance*.

- As next steps, your existing investment portfolio will be reviewed.

- Using the findings in “Discovery” phase as premise, we’ll assist you with executing the investments, along the lines of identified financial objectives.

- By Executing the same, you’d have defined what is required, while creating a timeline for completion. We’ll be responsible for consolidating your investments into a custom-designed asset allocation and investment strategy.

- Last but not the least, we’ll review your portfolio on an ongoing basis and have periodic reviews to check for any deviations.

We will make every effort to bring continuous improvements in our offerings to meet customer’s evolving expectations.

*Risk Tolerance – Risk tolerance is your ability and willingness to lose some or all of your original investment in exchange for greater potential returns. An aggressive investor, or one with a high-risk tolerance, is more likely to risk losing money in order to get better results. A conservative investor, or one with a low-risk tolerance, tends to favour investments that will preserve his or her original investment.

*Risk Tolerance – Risk tolerance is your ability and willingness to lose some or all of your original investment in exchange for greater potential returns. An aggressive investor, or one with a high-risk tolerance, is more likely to risk losing money in order to get better results. A conservative investor, or one with a low-risk tolerance, tends to favour investments that will preserve his or her original investment.